|

|

|

Esta página no está disponible en español. Why Are Latinos Leading Blacks In The Job Market?… Here Come The Latino Home Buyers

Why Are Latinos Leading Blacks In The Job Market? By Roger O. Crockett in Chicago March 15, 2004 BUSINESSWEEK

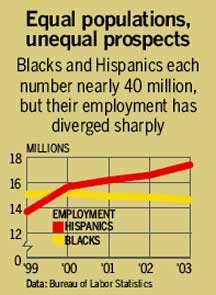

No question, Latinos have fared better in the job market recently. Despite the recession and the jobless recovery, their employment has surged by 27% since 1999, to 17.4 million last year, according to the Bureau of Labor Statistics (charts). Meanwhile, the number of employed blacks fell by 400,000 over this period, to 14.7 million. True, the Hispanic jobless rate has climbed two percentage points since its 2000 low, to 7.7% last year. That's because Latinos have entered the labor force to look for work at a faster pace than jobs have become available. Of course, Hispanics are highly diverse, so the total stat masks the 10% jobless rate for Puerto Rican men, for example, vs. a 6% rate for Cuban men, who tend to have more education. Still, black joblessness not only has been higher than the Latino average for years but has also jumped more: three percentage points since 2000, to 10.8% last year. Why such differences, even though there are roughly the same number of blacks and Hispanics in the U.S.? Chalk most of it up to the several hundred thousand Latinos pouring into the U.S. every year, mostly from Mexico. While many head for neighborhoods where they know someone, others have no established roots and are freer to chase jobs from California to North Carolina. Hispanics are also more likely to work in industries that have defied economic malaise, including agriculture, construction, and services such as laundry and landscaping. Construction has added 670,000 jobs in the past three years as builders kept pace with booming demand. Fully 12.5% of employed Hispanics work in construction, while only 4.7% of blacks do. Meanwhile, blacks have a long history of disproportionate employment in manufacturing, finance, and government -- all hit hard in recent years. Over 10% work in manufacturing, which shed nearly 1 million jobs in the past year. While 13% of Latinos work in factories, too, blacks are focused in much harder-hit durable goods such as cars, steel, and electronics. So they suffered factory-job losses of almost 500,000 since December, 2000, while Latinos, who tend to work in less affected industries, such as food processing, lost only 65,000 factory posts. Latinos' willingness to work for less pay may play a role in their faster hiring rate, too. At $440, the average weekly earnings of Hispanics are nearly 15% less than what blacks make and 31% less than whites. A lot of that reflects Hispanics' lower educational levels. More-educated blacks have walked away from the $9 an hour offered to entry-level workers by Canyon Fireplace in Anaheim, Calif. But Hispanics "take it and run," says owner Robert D. Lewis. The outcome: More Latinos than blacks are rising with the employment tide. Here Come The Latino Home Buyers Former HUD Secretary Henry Cisneros says by decade's end, this group will buy some 3 million homes, including thousands from his company March 15, 2004 BUSINESSWEEK Few executives have had as varied a career as Henry Cisneros. He was the first Hispanic mayor of a major U.S. city (San Antonio). Later, he served as U.S. Housing & Urban Development Secretary under President Clinton and then as president of Hispanic broadcaster Univision Communications (UVN ) in the 1990s. Today, operating once again out of his home base in San Antonio, Cisneros is chairman and CEO of American CityVista, a joint venture between himself and Los Angeles-based homebuilder KB Home (KBH ). His plan, as he explained it to BusinessWeek Online, is to bring the economies of scale of a large suburban homebuilder into urban, often Hispanic, markets where housing demand is expected to surge. He recently spoke with BusinessWeek's Christopher Palmeri. Edited excerpts from their conversation follow: Q: Is Corporate America really starting to notice Hispanic consumers? A: I know the impact of this market from my time at Univision (UVN ). It's the fifth-most-watched network in the country. In some markets, like Los Angeles and Miami, it's the most watched. Companies are starting to recognize that this market is no longer a sideline, goodwill, or philanthropy, but a good business. The auto industry is looking at a dramatic leveling of sales as the boomers reach their mid 50s and slow down their car buying. If you take the Latinos out, you see flat to no growth. Add the Latinos, and the car market grows 100,000 vehicles per year. You're seeing companies making decisions based on that. Toyota is building a plant in San Antonio. They picked that location with the input of their marketing team because they wanted a bigger presence in states where Latinos are a large part of the population. Latinos will be the workers in the plant. Many, many other companies are making similar calculations. Every company wants to appeal to a demographic that is younger and with families that are larger. Q: And that's true even in homebuilding? A: Because of KB's footprint in the Southwest, almost everywhere the market is Latino. KB could become the builder of choice with the fastest-growing demographic in the U.S. Our mission is to take KB's suburban production capabilities and deploy them in central cities. By definition, we have a close relationship with Latinos. What we're finding is it's a huge opportunity because of the rate of household formation. It's the fastest growth in home ownership of any group in the U.S. Ten million new homes will be formed by end of the decade, half of those will be minority, and more than half of those will be Hispanic. That's almost 3 million new homes that can be sold to Latino households. Q: What does it require to reach Hispanic consumers? A: It means staffing with Spanish speakers [and] materials in Spanish, focusing on homeowner education, credit repair, and financial literacy. We built a community in San Antonio -- Lago Vista. No new homes had been built there in 40 years. People were skeptical. We sold 280 homes in two years. The estimate at the outset was $80,000 to $90,000 per home. In fact, they're selling in the $150,000 range. They're requiring unique design, such as larger family space. There's a new open floor plan, where the kitchen is integrated with the living and dining area. So Momma can cook and watch the children who are playing or doing their homework. It plays to Latino sensibilities, people staying closer together, the yards with facilities for outdoor barbecuing. Things that relate to the Latino lifestyle of socializing with extended family. We design for people's needs. With the Latino family they average more rooms. A lot of Latinos want to stay near extended family, in old neighborhoods, near their church. The most frequent thing I'll hear is, "Thank you for building homes in this part of town. I always wanted to live here, but there were no new homes. My mother is taking care of the children." It's just very common, family members taking care of each other. Q: Isn't the reason that builders neglected these neighborhoods because the residents couldn't afford new homes? A: We're working a lot with lenders. Now they pay attention to things like the way they count rental experience, they help people correct credit problems. The Latino population is immensely hard-working. It's low-wage, but they have two, three, or four workers per household. In Southern California, 52% had at least three workers in the home. So the whole household functions as a middle-class unit. They may work as gardeners, but when you have three people working, they live like the middle class. It's a huge phenomenon. Q: So immigration, from your perspective, is still a good thing for the U.S.? A: It's going to be one of the saving graces of our country. Japan, like Germany, France, and Italy, is worried about the aging and homogeneity of their population. They are facing negative growth scenarios. Here in the U.S., we have this younger, hard-working population, whose best working years are still ahead. Most Americans don't recognize what an asset this is. Most people think they are less educated. They speak with an accent, but they are a huge contribution to the country. Q: But is there a danger America will actually have a class of citizens speaking only Spanish? A: People learn English, the second generation. American culture is so powerful, from music, pop culture, and sports. That acculturation is very rapid in a generation or two. It's not unusual to find younger Latinos completely acculturated by the second generation. I concluded a long time ago [that] God gave us brains with a lot of capacity. When we learn English, we don't have to displace Spanish. There's a lot of capacity to add and not subtract, it's a net plus. Q: What are your growth projections for American CityVista? How much do the homes cost, and what percentage of the buyers are Hispanic? A: We've sold over 1,500 homes. With the communities we now have under construction, we'll sell 2,500 more. With those communities that are approved [but not yet under construction], 8,000 homes. In Texas, they run $90,000 to $150,000. In California, they start at $230,000. Our sales are probably 40% Hispanic.

|

The booming Hispanic labor force turns out to have an unexpected side effect: Latinos are outperforming blacks in the job market. Part of the reason stems from the fact that many Hispanics have less education or are vulnerable illegal immigrants willing to work for less pay. Economic and cultural factors play a role, too, say some experts, such as Latino immigrants' higher willingness to change cities to find a job. Add it up, and "many are hired to do work that blacks once had," says the Reverend Jesse Jackson.

The booming Hispanic labor force turns out to have an unexpected side effect: Latinos are outperforming blacks in the job market. Part of the reason stems from the fact that many Hispanics have less education or are vulnerable illegal immigrants willing to work for less pay. Economic and cultural factors play a role, too, say some experts, such as Latino immigrants' higher willingness to change cities to find a job. Add it up, and "many are hired to do work that blacks once had," says the Reverend Jesse Jackson.